Designed for the young investor

We prioritize low-risk strategies with steady income streams through derivatives trading (DerivAI).

We prioritize low-risk strategies with steady income streams through derivatives trading (DerivAI). Our AI algorithms adapt to focus on long-term trends, ensuring that your investments align with your child’s future needs and financial goals.

Our AI algorithms adapt to focus on long-term trends, ensuring that your investments align with your child’s future needs and financial goals. We provide in-depth analysis of global market trends and economic indicators, allowing you to make informed investment decisions.

We provide in-depth analysis of global market trends and economic indicators, allowing you to make informed investment decisions. Client Retention: 97% of our starter account clients continue to invest with Sela, highlighting our exceptional service and impressive returns.

Client Retention: 97% of our starter account clients continue to invest with Sela, highlighting our exceptional service and impressive returns.- John M., 42, Software Engineer

Sela Starter Account FAQ

What is the recommended minimum investment for the Sela Starter Account?

To yield optimal results and fully benefit from the features and services of the Sela Starter Account, we recommend a minimum investment of $500. This threshold allows us to implement effective investment strategies and maximize your returns.

What are the fees associated with the Sela Starter Account?

The Sela Starter Account has a competitive fee structure of 0.15%, which is charged only on the profits earned through your investments. This ensures that you retain the majority of your returns while benefiting from our advanced wealth management services.

Is my investment insured?

Yes, your investment in the Sela Starter Account is insured under the UK Financial Compensation Scheme. This provides an additional layer of security, ensuring that your funds are protected up to the statutory limit in case of any financial issues with the investment firm.

How does Sela ensure the safety of my account and personal information?

We take the safety of your account and personal information very seriously. Our platform utilizes robust encryption protocols to safeguard your data. Additionally, we implement two-factor authentication (2FA) for all account accesses, adding an extra layer of protection to your account.

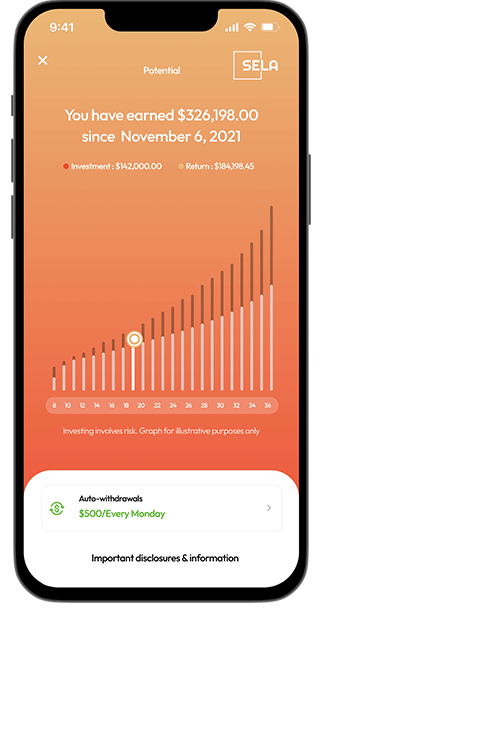

What are the expected returns for the Sela Starter Account?

Investors in the Sela Starter Account can expect monthly returns ranging from 3% to 5%. These returns are achieved through our advanced AI trading bot, DerivAI, even though the access is not full, our strategic investment management is tailored to your financial goals.

How do the fees work and are there any other hidden charges?

The fee for the Sela Starter Account is 0.15% of the profits earned, ensuring that you only pay when your investments generate returns. There are no hidden fees or charges; transparency is a key part of our service commitment to you.

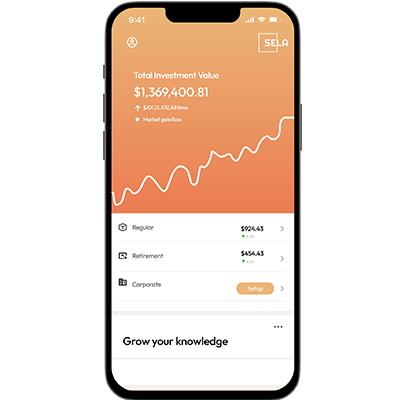

How can I withdraw funds from my Sela Starter Account?

Withdrawing funds from your Sela Starter Account is quick and easy. You can request a withdrawal directly from your client dashboard. Once requested, funds are typically received within 1-3 hours, providing you with fast and convenient access to your money when you need it.

Can I add beneficiaries to my Sela Starter Account?

Yes, the Sela Starter Account allows you to add one beneficiary. This feature ensures that your investment can be easily transferred to a designated individual, providing an additional layer of security and planning for your financial future.