Designed for Business Thought Leaders

Risk Management: For companies seeking conservative investment approaches, we prioritize low-risk strategies with steady income streams through interbank lending (InterAI).

Risk Management: For companies seeking conservative investment approaches, we prioritize low-risk strategies with steady income streams through interbank lending (InterAI). Capital Growth: Companies aiming for aggressive growth can leverage high-yield opportunities in cryptocurrency trading (ChadAI) and derivatives trading (DerivAI), maximizing capital growth potential.

Capital Growth: Companies aiming for aggressive growth can leverage high-yield opportunities in cryptocurrency trading (ChadAI) and derivatives trading (DerivAI), maximizing capital growth potential. Industry-Specific Focus: Our AI algorithms are adaptable and can be programmed to focus on specific industry trends, ensuring that your investments align with your company's sector dynamics.

Industry-Specific Focus: Our AI algorithms are adaptable and can be programmed to focus on specific industry trends, ensuring that your investments align with your company's sector dynamics. Global Market Insights: We provide in-depth analysis of global market trends and economic indicators, allowing your company to make informed investment decisions across diverse markets.

Global Market Insights: We provide in-depth analysis of global market trends and economic indicators, allowing your company to make informed investment decisions across diverse markets. Increased profits: Clients using the Sela Corporate Account have experienced an average profit growth of 35% within the first year of implementation.

Increased profits: Clients using the Sela Corporate Account have experienced an average profit growth of 35% within the first year of implementation. Market Outperformance: Our corporate clients consistently outperform industry benchmarks by an average of 10% annually, thanks to Sela's advanced AI technology.

Market Outperformance: Our corporate clients consistently outperform industry benchmarks by an average of 10% annually, thanks to Sela's advanced AI technology.- CTO, Global Manufacturing Conglomerate

Sela Corporate Account FAQ

What is the minimum investment requirement for the Sela Corporate Account?

To yield optimal results and fully benefit from the comprehensive features and services of the Sela Corporate Account, a minimum investment of $500,000 is required. This threshold allows us to implement advanced investment strategies tailored to corporate needs and maximize your returns.

What are the fees associated with the Sela Corporate Account?

The Sela Corporate Account has a fee structure of 0.50%, which is charged only on the profits earned through your investments. This ensures that you retain the majority of your returns while benefiting from our sophisticated corporate wealth management services.

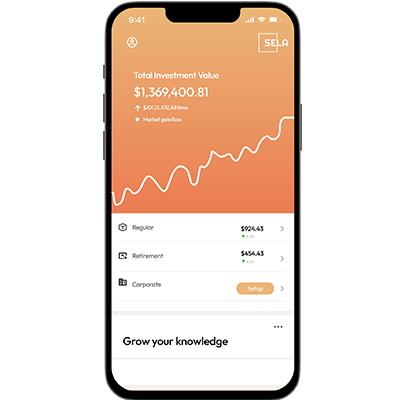

Do I have access to corporate wealth management software?

Yes, as a Sela Corporate Account holder, you will have exclusive access to our advanced corporate wealth management software. This powerful tool provides comprehensive financial analysis, reporting, and strategic planning capabilities to help manage your corporate investments effectively.

Is my investment insured?

Yes, your investment in the Sela Corporate Account is insured under the UK Financial Compensation Scheme. This provides an additional layer of security, ensuring that your funds are protected up to the statutory limit in case of any financial issues with the investment firm.

How does Sela ensure the security of my investments and personal information?

We take the security of your investments and personal information very seriously. Our platform utilizes robust encryption protocols to safeguard your data. Additionally, we implement two-factor authentication (2FA) for all account accesses, adding an extra layer of protection to your account.

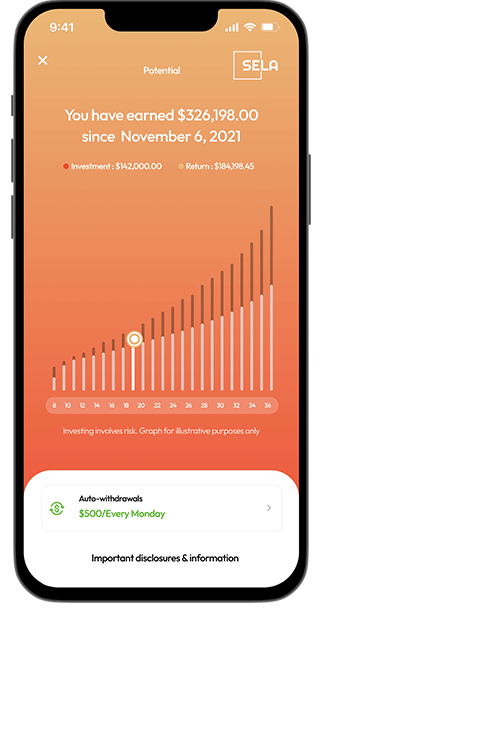

How does monthly compounding work in the Sela Corporate Account?

The Sela Corporate Account benefits from monthly compounding of returns. This means that the returns earned each month are reinvested, allowing your investment to grow at an accelerated rate over time. This compounding effect significantly enhances the growth potential of your corporate portfolio.

What are the expected returns for the Sela Corporate Account?

Investors in the Sela Corporate Account can expect monthly returns ranging from 17% to 20%. These returns are achieved through a combination of our advanced AI trading bots (InterAI, ChadAI, and DerivAI) and our personalized investment strategies tailored to meet corporate goals.

How do the fees work and are there any other hidden charges?

The fee for the Sela Corporate Account is 0.50% of the profits earned, ensuring that you only pay when your investments generate returns. There are no hidden fees or charges; transparency is a key part of our service commitment to you.

How can I withdraw funds from my Sela Corporate Account?

Withdrawing funds from your Sela Corporate Account is straightforward and secure. You can request a withdrawal directly from your client dashboard. Due to AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements, withdrawals are processed within 5-7 business days, ensuring compliance with all regulatory standards.

Can I add beneficiaries to my Sela Corporate Account?

Yes, the Sela Corporate Account allows you to add up to three beneficiaries. This feature ensures that your investment can be easily transferred to designated individuals or entities, providing an additional layer of security and planning for your corporate financial future.