Plan for a secure and prosperous retirement

Sign-Up Increase: Sela Retirement Account sign-ups have increased by 45% in the past year.

Sign-Up Increase: Sela Retirement Account sign-ups have increased by 45% in the past year. Performance: Clients have reported an average annual return of 14%, thanks to the advanced AI trading strategies

Performance: Clients have reported an average annual return of 14%, thanks to the advanced AI trading strategies Enhanced Security: end-to-end encryption and multi-factor authentication, ensuring that your funds and personal information are secure at all times.

Enhanced Security: end-to-end encryption and multi-factor authentication, ensuring that your funds and personal information are secure at all times.From the initial consultation to the ongoing management of my retirement account, the team has consistently shown a deep understanding of my financial goals and a genuine commitment to securing my future. Their personalized approach and transparent communication have given me confidence and peace of mind that my investments are in good hands. Thanks to their expertise and dedication, I feel prepared and optimistic about my retirement.

- T. Morrison, 42, Data Scientist at Linux

Sela Retirement Account FAQ

What is the recommended minimum investment for the Sela Retirement Account?

To yield optimal results and fully benefit from the comprehensive features and services of the Sela Retirement Account, a minimum investment of $100,000 is required. This threshold allows us to implement advanced investment strategies and maximize your returns.

What are the fees associated with the Sela Retirement Account?

The Sela Retirement Account has a fee structure of 0.35%, which is charged only on the profits earned through your investments. This ensures that you retain the majority of your returns while benefiting from our sophisticated wealth management services.

Is my investment insured?

Yes, your investment in the Sela Retirement Account is insured under the UK Financial Compensation Scheme. This provides an additional layer of security, ensuring that your funds are protected up to the statutory limit in case of any financial issues with the investment firm.

How does Sela ensure the security of my investments and personal information?

We take the security of your investments and personal information very seriously. Our platform utilizes robust encryption protocols to safeguard your data. Additionally, we implement two-factor authentication (2FA) for all account accesses, adding an extra layer of protection to your account.

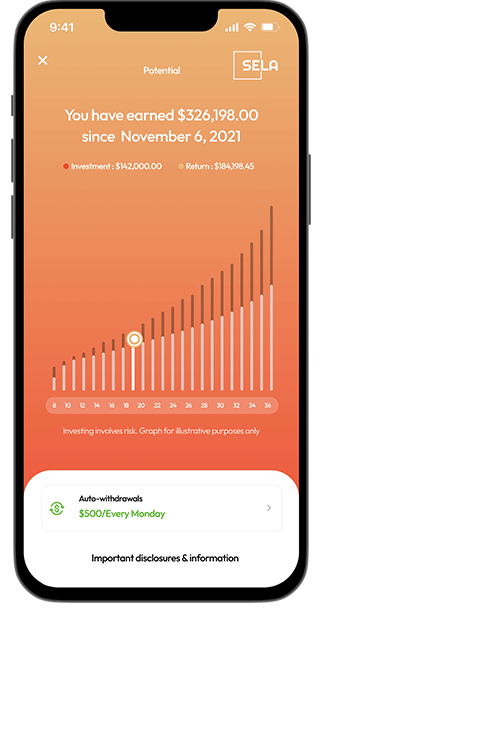

How does monthly compounding work in the Sela Retirement Account?

The Sela Retirement Account benefits from monthly compounding of returns. This means that the returns earned each month are reinvested, allowing your investment to grow at an accelerated rate over time. This compounding effect significantly enhances the growth potential of your portfolio.

What are the expected returns for the Sela Retirement Account?

Investors in the Sela Retirement Account can expect monthly returns ranging from 13% to 15%. These returns are achieved through a combination of our advanced AI trading bots (InterAI, ChadAI, and DerivAI) and our personalized investment strategies tailored to your retirement goals.

How do the fees work and are there any other hidden charges?

The fee for the Sela Retirement Account is 0.35% of the profits earned, ensuring that you only pay when your investments generate returns. There are no hidden fees or charges; transparency is a key part of our service commitment to you.

How can I withdraw funds from my Sela Retirement Account?

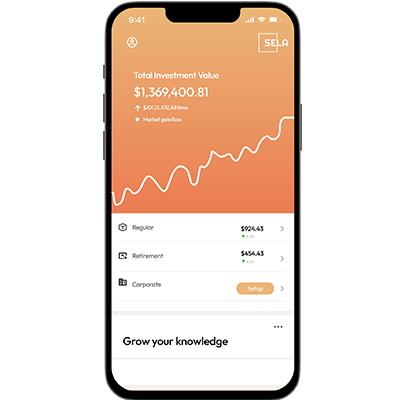

Withdrawing funds from your Sela Retirement Account is quick and easy. You can request a withdrawal directly from your client dashboard. Once requested, funds are typically received within 1-3 working days, providing you with fast and convenient access to your money when you need it.

Join our community of satisfied clients today and start building your future with Sela.

Sign up