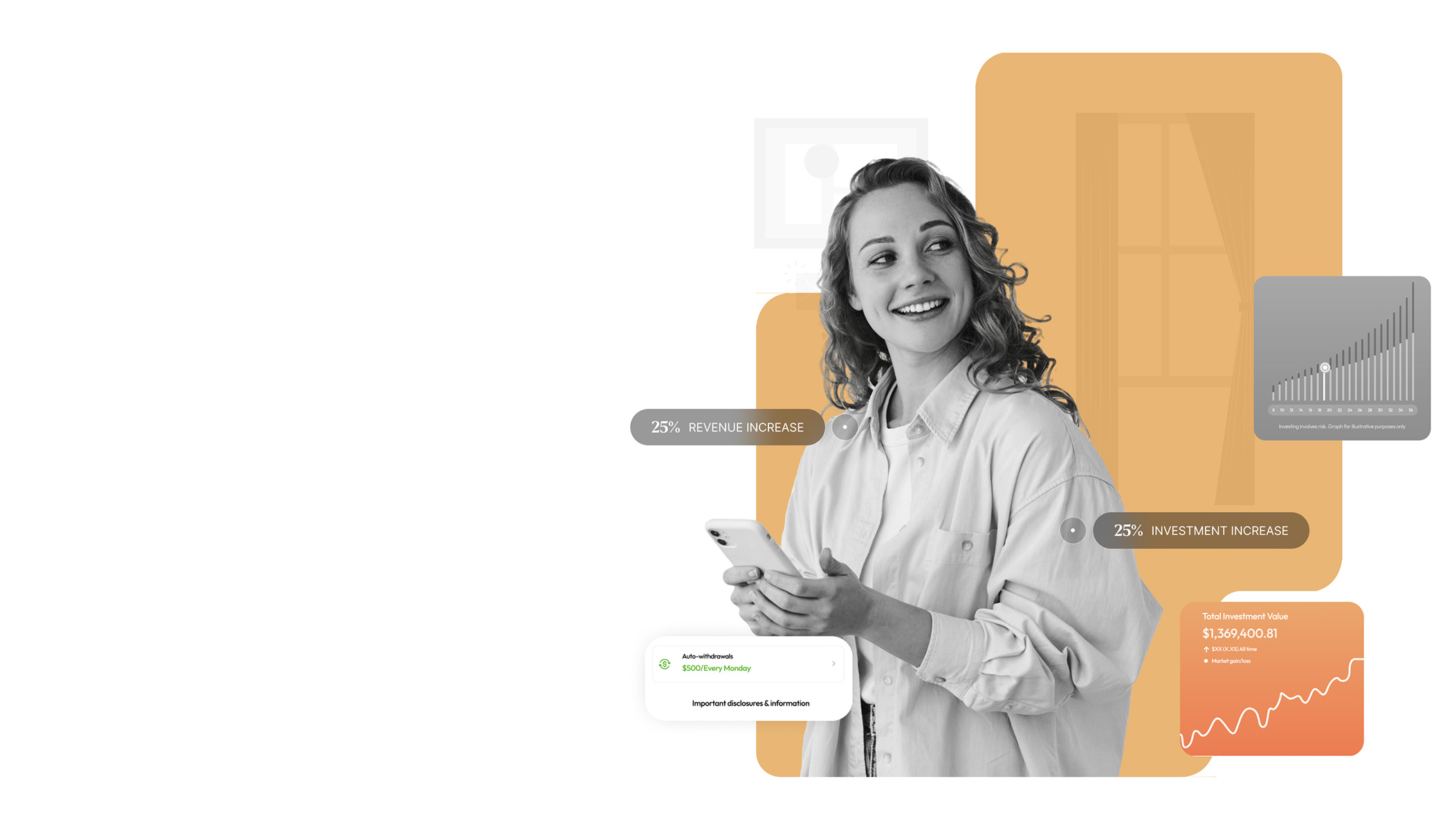

Sela is poised to disrupt the investment management industry

Sela enables high-growth potential with exposure to innovation through digital assets, including cryptocurrencies. This asset class has a different risk profile compared to stocks and bonds, offering diversification benefits. Our goal is to maximize returns while minimizing risk, ensuring a smoother path to financial success.

Sela diversified portfolios are constructed by experts and include ETFs managed by pros with working experience at the world’s top investment firms like Morgan Stanley and BlackRock.

Your investments are held separately from our company's assets. This segregation provides an additional layer of protection in the unlikely event of our insolvency.

In the event that Sela Investment Management is unable to meet its obligations, eligible clients may be entitled to compensation under the FSCS. The FSCS protects investments up to a certain limit per client per regulated activity.

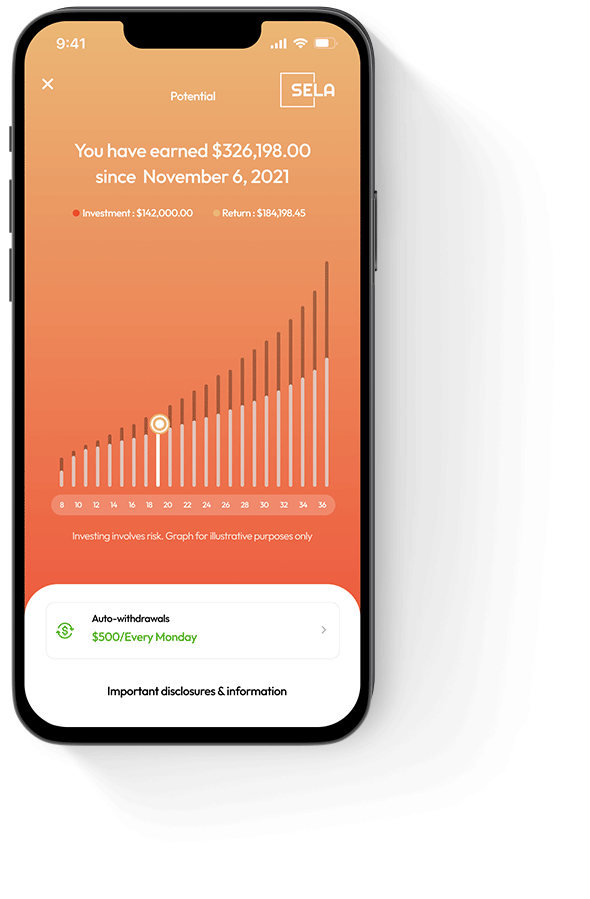

Compounding allows investment earnings to generate additional returns over time, significantly boosting the overall growth of an investment account. Sela’s weekly compounding schedule accelerates this process by frequently reinvesting earnings, which maximizes potential returns and enhances the power of compounding. This regular reinvestment strategy helps clients achieve higher growth rates on their investments, leading to substantial financial gains over the long term.

By compounding client accounts, we maximize the frequency at which your returns are reinvested, accelerating the overall growth of your portfolio.